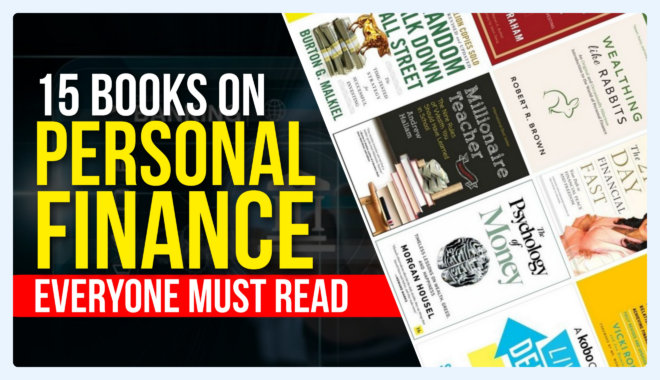

15 Money Books

Dear readers, we’ve got something extra special lined up for you – a life-changing compilation that will take your personal finance game to a whole new level! – 15 Money Books on Personal Finance – Everyone Must Read.

Money is essential to our lives, and most of us need to improve at managing it. For this reason, many of us face many problems related to money. But do you know that you can get out of most of your money problems just by taking financial knowledge? You got it right. Even if your income is limited, you can get out of most of the issues related to your money.

After understanding these books, you will be able to learn how to manage your money, get out of loans or debt, will be able to set financial goals and achieve them, will be able to avoid financial risk, will be able to learn everything about investing, and will be able to achieve financial freedom by building wealth. And read this blog till the end because the last three books are my favorite.

Book 1. “The Total Money Makeover” by Dave Ramsey

Renowned personal finance expert Dave Ramsey lays out a practical and proven plan for getting out of debt and achieving financial freedom. The book’s central principle is the “Baby Steps,” a series of seven sequential actions, including building an emergency fund, paying off debts using the debt snowball method, and investing for the future.

Ramsey advocates a cash-based budgeting system and preaches against using credit cards. His no-nonsense approach and emphasis on personal responsibility resonate with readers eager to take control of their financial lives. “The Total Money Makeover” is a motivational Money book and action-oriented book that has helped countless individuals break free from debt and build a secure financial foundation.

Link: https://amzn.to/3scWYzf

Book 2. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Based on extensive research into the lives of millionaires in America, this eye-opening book challenges common misconceptions about wealth. The authors reveal that many millionaires live frugally and practice disciplined financial habits, debunking the stereotype of lavish spending and extravagance.

They identify critical characteristics shared by millionaires, such as living below their means, investing wisely, and prioritizing financial independence over displaying wealth. Through real-life stories and statistical data, “The Millionaire Next Door” offers valuable lessons on building wealth and achieving financial security through prudent money management and long-term planning.

The book aims to inspire readers to have a money-making mindset and dispel the concept that a millionaire must live a luxurious life.

Link: https://amzn.to/45eDEQH

Book 3. “I Will Teach You to Be Rich” by Ramit Sethi

Geared towards young professionals and college students, this engaging book provides a six-week action plan for taking control of personal finances. Sethi’s approach is witty, humorous, and relatable, making it easy for readers to grasp complex financial concepts.

The book covers budgeting, saving, investing, and negotiating job offers. It emphasizes the importance of automating finances to build wealth systematically and encourages readers to focus on the big wins that can substantially impact their financial situation. “I Will Teach You to Be Rich” empowers readers to manage their money effectively and achieve their financial goals while enjoying life’s pleasures responsibly.

Link: https://amzn.to/3KLuy5R

Book 4. “Think and Grow Rich” by Napoleon Hill

A timeless classic in self-help and personal development, this book explores the power of thoughts and beliefs in shaping one’s destiny, including financial success. Hill draws on interviews with successful individuals, including Thomas Edison and Andrew Carnegie, to identify common principles that lead to prosperity.

He emphasizes the importance of setting clear financial goals, maintaining a burning desire to achieve them, and developing a positive mental attitude. Though not strictly a personal finance book, “Think and Grow Rich” lays the groundwork for understanding the psychology of wealth and the significance of mindset in pursuing financial goals.

Link: https://amzn.to/3P0OSCL

Book 5. “Rich Dad Poor Dad” by Robert T. Kiyosaki

This fantastic book presents a powerful contrast between two father figures in the author’s life – his “rich dad” (his best friend’s father) and his “poor dad” (his biological father). Through these perspectives, Kiyosaki shares essential financial lessons that have the potential to reshape readers’ beliefs about money and wealth.

The book emphasizes the importance of financial education, distinguishing between assets and liabilities, and building multiple passive income streams. It encourages readers to adopt a mindset focused on financial independence and entrepreneurship rather than settling for traditional employment.

Kiyosaki’s straightforward writing style and relatable anecdotes make complex financial concepts accessible to a broader audience, making “Rich Dad Poor Dad” a timeless bestseller and a must-read for those seeking financial success.

Link: https://amzn.to/3YI217a

Book 6. “Financial Freedom: A Proven Path to All the Money You Will Ever Need”

It is a book written by Grant Sabatier, a successful entrepreneur and personal finance expert. In this book, Sabatier outlines a comprehensive and actionable roadmap to achieve financial independence and attain the freedom to live life on your terms.

The book emphasizes the importance of increasing one’s income, reducing expenses, and investing wisely to accumulate wealth rapidly. Sabatier introduces the concept of “F.I.R.E” (Financial Independence, Retire Early), which has gained popularity among those seeking early retirement.

He shares his personal journey of going from being broke and unemployed to becoming a millionaire in just five years, using his proven principles and strategies.

“Financial Freedom” provides practical advice and tools, including budgeting tips, investment insights, and mindset shifts, to empower readers to take control of their finances and build a solid foundation for financial independence.

The book’s actionable strategies and motivational tone make it an excellent resource for individuals at any stage of their financial journey, from beginners looking to get started to experienced investors seeking to accelerate their progress toward financial freedom.

Link: https://amzn.to/3DXyPPX

Book 7. “The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

This comprehensive guide to investing is based on the principles of John C. Bogle, the founder of Vanguard and a proponent of low-cost index fund investing. The book provides straightforward advice on building a diversified portfolio, minimizing costs, and maintaining a long-term perspective.

The Bogleheads, a community of individual investors inspired by Bogle’s philosophy, advocate a passive approach to investing that avoids market timing and excessive trading. “The Bogleheads’ Guide to Investing” is an excellent resource for beginners and experienced investors alike, offering practical strategies to achieve financial goals without getting caught up in the noise and complexity of the financial industry.

Link: https://amzn.to/44fMzzW

Book 8. “The Richest Man in Babylon” by George S. Clason

Presented as parables set in ancient Babylon, this classic book imparts fundamental financial principles that remain relevant today. The stories provide simple yet powerful lessons on saving, investing, and managing money wisely.

Through the characters and their experiences, the book illustrates the importance of living below one’s means, avoiding debt, and acquiring income-generating assets. “The Richest Man in Babylon” advocates for taking control of one’s financial destiny and laying the foundation for a secure and prosperous future. Its timeless wisdom inspires readers worldwide to adopt responsible financial habits and build wealth over time.

Link: https://amzn.to/3P0hR9H

Book 9. “Broke Millennial” by Erin Lowry

Geared towards millennials facing unique financial challenges, this book offers practical advice on managing money effectively and navigating the complexities of personal finance. Erin Lowry covers various topics, from budgeting and saving to investing and dealing with student loans.

The book’s conversational and relatable tone makes it accessible to young readers intimidated by traditional personal finance books. Lowry’s “no-nonsense” approach encourages millennials to take control of their financial lives and make informed decisions about their money.

“Broke Millennial” is an excellent starting point for young adults looking to gain financial literacy and build a solid financial foundation for their future.

Link: https://amzn.to/3QExkxz

Book 10. “The Simple Path to Wealth” by J.L. Collins

In this practical and concise book, J.L. Collins presents a no-nonsense guide to achieving financial independence and retiring early. Collins advocates for a straightforward approach to investing, primarily focusing on low-cost index funds.

He explains the power of the stock market and how investing in broad-market funds can lead to significant long-term gains. The author also emphasizes the importance of frugality, living below one’s means, and avoiding debt to accumulate wealth.

“The Simple Path to Wealth” is particularly well-suited for beginners, as it simplifies complex financial concepts and offers a clear step-by-step plan to build a solid financial foundation. The book’s approach is backed by Collins’s personal experience, making it a relatable and inspiring read for anyone aspiring to achieve financial freedom.

Link: https://amzn.to/3OYXLwG

Book 11. “The Automatic Millionaire” by David Bach

David Bach’s “The Automatic Millionaire” introduces a compelling concept called “pay yourself first,” where he encourages readers to automate their savings and investment contributions. The book highlights the importance of setting up automatic systems that funnel money into retirement accounts and other investments before one has a chance to spend it impulsively.

Bach shows how ordinary individuals can build substantial wealth over time by emphasizing consistency and discipline. He also stresses the significance of homeownership and its role in building net worth. The book’s engaging writing style and practical advice make it accessible to readers from various financial backgrounds.

Whether you are just starting your financial journey or seeking to improve your existing money habits, “The Automatic Millionaire” provides actionable strategies to help you achieve your financial goals.

Link: https://amzn.to/3OxUeDW

Book 12. “The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money” by Carl Richards

Carl Richards, a certified financial planner, delves into the behavioral aspects of personal finance and investing in “The Behavior Gap.” The book focuses on the common mistakes people make due to emotional decision-making, such as buying high and selling low, and how these behaviors can lead to financial setbacks.

Richards uses simple illustrations to convey that emotions often drive financial choices, even when they go against logic. The book emphasizes the importance of having a solid financial plan, sticking to it, and avoiding impulsive actions during market fluctuations.

“The Behavior Gap” is a thought-provoking and insightful read that encourages readers to be aware of their financial behavior and develop strategies to avoid costly mistakes.

Link: https://amzn.to/3DZ94yy

Book 13. “The Intelligent Investor” by Benjamin Graham

Often referred to as the “bible of investing,” this classic book provides timeless wisdom for approaching the stock market and investing wisely. Written by renowned economist and value investor Benjamin Graham, who was also a mentor to Warren Buffett, the book emphasizes the importance of fundamental analysis and long-term thinking.

Graham introduces the “Mr. Market” concept to illustrate the market’s irrationality and the importance of remaining unswayed by short-term fluctuations. He also introduces the idea of a “margin of safety” when investing, a principle that has become a cornerstone of value investing.

“The Intelligent Investor” is a must-read for anyone interested in stock market investing, offering practical insights and a rational approach to navigating the often turbulent waters of the financial markets.

Link: https://amzn.to/47BrwL8

Book 14. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

This influential book challenges conventional ideas about money and work, offering a nine-step program for achieving financial independence and finding fulfillment. The authors focus on “life energy,” helping readers understand the actual cost of their purchases in terms of time spent working to afford them.

The book encourages readers to align spending with values and prioritize experiences over material possessions. It also delves into saving and investing wisely to secure a comfortable future. The practical exercises and thought-provoking concepts in “Your Money or Your Life” have motivated countless readers to reassess their relationship with money and make conscious choices that lead to greater financial freedom and happiness.

Link: https://amzn.to/47NUoQG

Book 15. “Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth”

It is a transformative book written by T. Harv Eker, a successful entrepreneur and motivational speaker. In this book, Eker delves into the psychology of wealth and explores how one’s mindset and beliefs significantly impact financial success.

Eker introduces the concept of the “money blueprint,” which refers to individuals’ subconscious beliefs and thought patterns about money. He explains how these deeply ingrained beliefs, often formed during childhood, shape one’s financial reality.

If someone’s money blueprint is set for scarcity and limitations, they will continue to struggle with money, regardless of their income level. The book identifies seventeen “wealth files,” specific thought patterns, and strategies wealthy individuals adopt.

Eker shares practical insights and action steps to shift one’s money blueprint from scarcity to abundance, enabling readers to adopt the mindset and habits of millionaires.

Link: https://amzn.to/47DU5rC

Conclusion

So friends, after reading this, you must have understood how important all these books are for us; now is the time to understand them in detail. We have made videos of some books; you can also watch them at our YouTube channel – Readers Books Club.

And you can tell us by commenting on the books you want us to make videos on. See you soon with more great blogs.

Thank you so much.

Contents